Homepage / Forensic audit — Financial investigations and procurement audits

Forensic Audit - Financial Investigations and Procurement Audit

What is Forensic Audit?

Forensic Audit -

is an advanced international tool for financial analysis, highly valued by executives, investors, and business owners for its ability to promptly identify hidden risks and enhance trust.

By applying modern technologies, forensic audit enables an in-depth analysis of an organization’s financial activities, minimizes losses, and implements effective measures to prevent threats.

Our approach ensures comprehensive financial security by providing objective and reliable data for strategic decision-making.

- Beware of fake organizations offering forensic services without proper practical experience or pretending to be working with us!

- Остерегайтесь поддельных организаций, предлагающих услуги форензик без должного практического опыта или прикрывающихся мнимым сотрудничеством с нами!

When Our Services Are Needed

When There Is a Need for a Forensic Audit

Preventing potential violations before an upcoming inspection

Risks identified in procurement, production, storage, sales, or financial accounting processes

Signs of financial leakage or misappropriation of funds

Obtaining an independent positive conclusion before leaving a managerial position

Taking a new position and assessing risks of violations by the previous team

Increase in expenses despite stable revenue levels

Need to protect investments or monitor the targeted use of financial resources

Lack of confidence in management from founders or higher authorities

Goals and Practical Value of Forensic Audit

Identifying Hidden Risks

Forensic audit aims to promptly identify hidden risks that may cause financial or reputational damage to executives, investors, and business owners.

Protecting Executives from Misconduct

In practice, executives who place trust in their employees often face challenges alone during inspections by regulatory authorities. In such situations, dishonest employees may expose their leaders to liability, resulting in financial losses and reputational damage.

Assessing Team Performance and Business Resilience

Forensic analysis also assists in evaluating the team’s reliability and stress resistance, identifying weak links, and improving management effectiveness in challenging situations.

Preventing Consequences and Building Trust

Timely engagement of forensic services helps significantly reduce or eliminate such risks. This prevents negative outcomes and strengthens the trust of investors and shareholders.

Protecting Executives from Misconduct

In practice, executives who place trust in their employees often face challenges alone during inspections by regulatory authorities. In such situations, dishonest employees may expose their leaders to liability, resulting in financial losses and reputational damage.

Assessing Team Performance and Business Resilience

Forensic analysis also assists in evaluating the team’s reliability and stress resistance, identifying weak links, and improving management effectiveness in challenging situations.

Forensic Audit Integrates

Forensic or Audit?

Differences Between Forensic Audit and Financial Audit

Forensic Audit

Focused on identifying, investigating, and preventing hidden risks, including fraud and other irregularities. Its primary purpose is to gather evidence to support management decisions, ensure financial security, and, when necessary, provide documentation for potential legal proceedings.

Financial Audit

Aimed at verifying the accuracy and reliability of a company’s financial statements in accordance with international or national accounting standards (e.g., IFRS, NAS). The auditor expresses an independent opinion on whether the company’s financial position is presented fairly and in compliance with established standards.

How we work

Working Methods

- Analysis of related-party relationships

- Forensic Check & Identification of Red Flags

- Review of accounting and tax records

- Interviews with employees and third parties

- Examination and analysis of counterparties

- Investigation of capital and asset diversion incidents

- Review of compliance with regulatory and legal requirements

- Use of technical monitoring tools

- Use of Polygraph (lie detector) when applicable

Answers to questions

How is the confidentiality of services ensured?

All information related to the service provided is treated as confidential and showed only to the Client (an NDA – Non-Disclosure Agreement – is signed).

Upon completion of the work, the results and conclusions of the study are usually confidentially provided to the first manager (customer).

Which specialists provide the services?

Forensic procedures are carried out by certified forensic experts and auditors specializing in financial fraud investigations, audit reviews, and related services.

Our team includes:

forensic professionals;

forensic professionals;

auditors;

auditors;

analysts;

analysts;

lawyers;

lawyers;

financial experts;

financial experts;

tax consultants;

tax consultants;

cybersecurity specialists;

cybersecurity specialists;

corporate intelligence specialists.

corporate intelligence specialists.

Is a license needed to provide Forensic services?

Forensic procedures are conducted in accordance with International Standards on Auditing (ISA).

Our company is officially registered in the Register of Audit Organizations of the Republic of Uzbekistan.

What stages are included in the service process?

Initial meeting and discussion with management

Signing of the NDA (Non-Disclosure Agreement)

Client completes the request form to define the scope of work

Contract signing (if required, via electronic platforms)

Formation and approval of the audit team

Development and approval of the Audit Program

On-site audit procedures

Daily audit team briefings

Presentation of results

Expert confidential report and recommendations

How much do the services cost?

The cost depends on:

The object (nature of activity, volume of working capital);

The number of experts involved;

The location or remoteness of the analysis sites.

To calculate the cost, an application form must be completed.

What is the duration of the services?

The period depends on the complexity and multitasking nature of the work. After the initial visit and review of the scope of work, the duration of the service can be determined.

Some organizations choose to purchase an annual service subscription, which allows them to save considerable financial resources compared to maintaining in-house specialists (such as compliance inspectors, internal auditors, and other experts).

For example, one full-time employee with a salary of 15 million UZS per month costs around 180 million UZS per year, excluding bonuses and other payments. In many cases, over time, in-house employees may become involved in collusion schemes promoting illegal financial activities.

How is the Forensic Audit Program prepared?

The Forensic Audit financial investigation program is developed considering the specifics of each case and the Client’s requirements.

What methodology is used in conducting Forensic?

Forensic is a complex and responsible process that requires a high level of knowledge, skills, and experience.

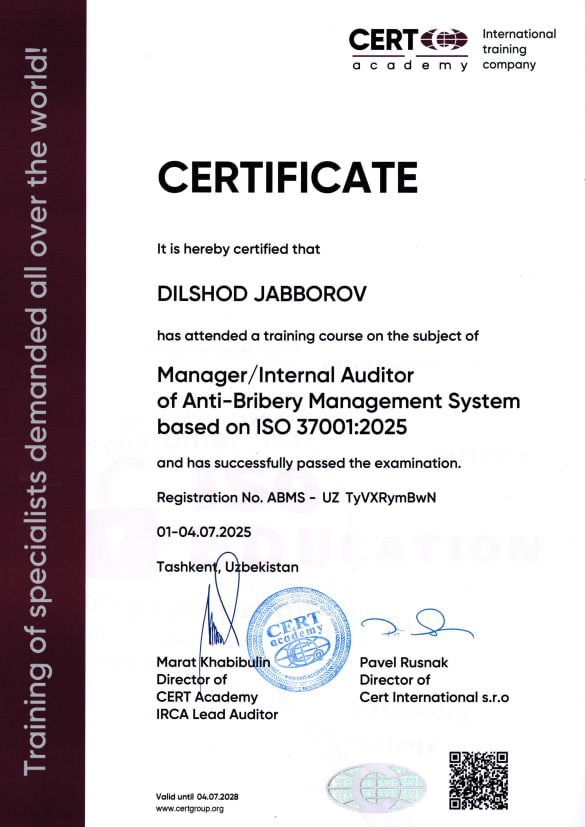

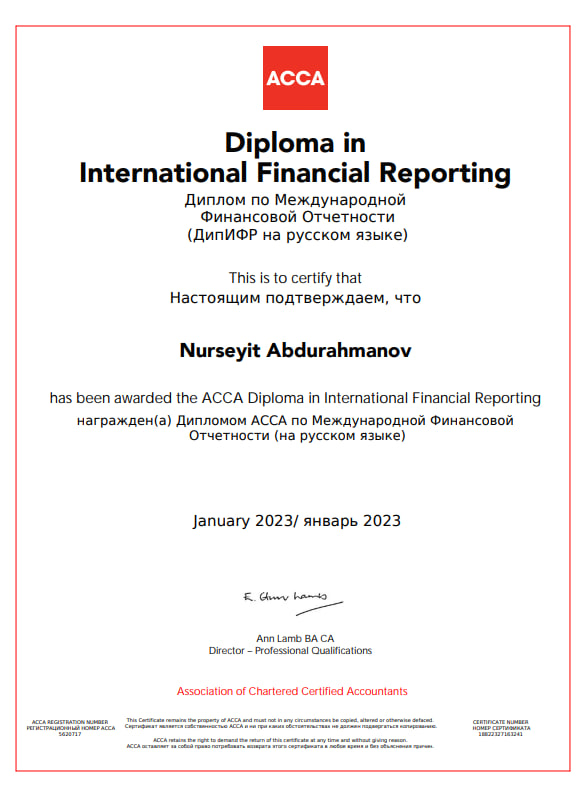

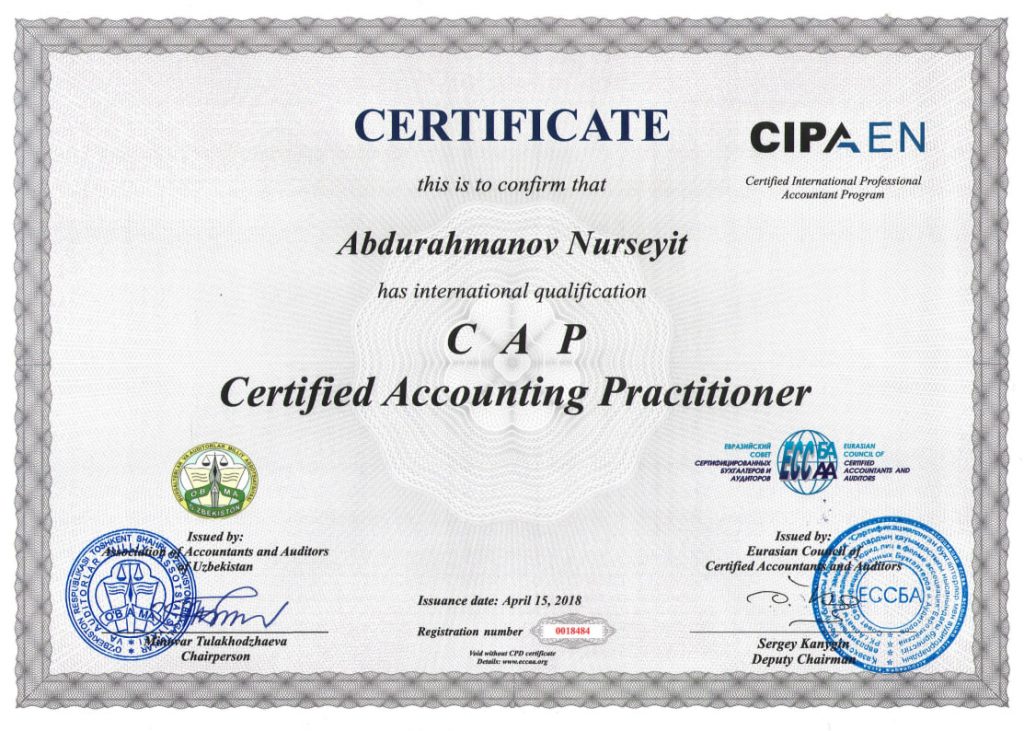

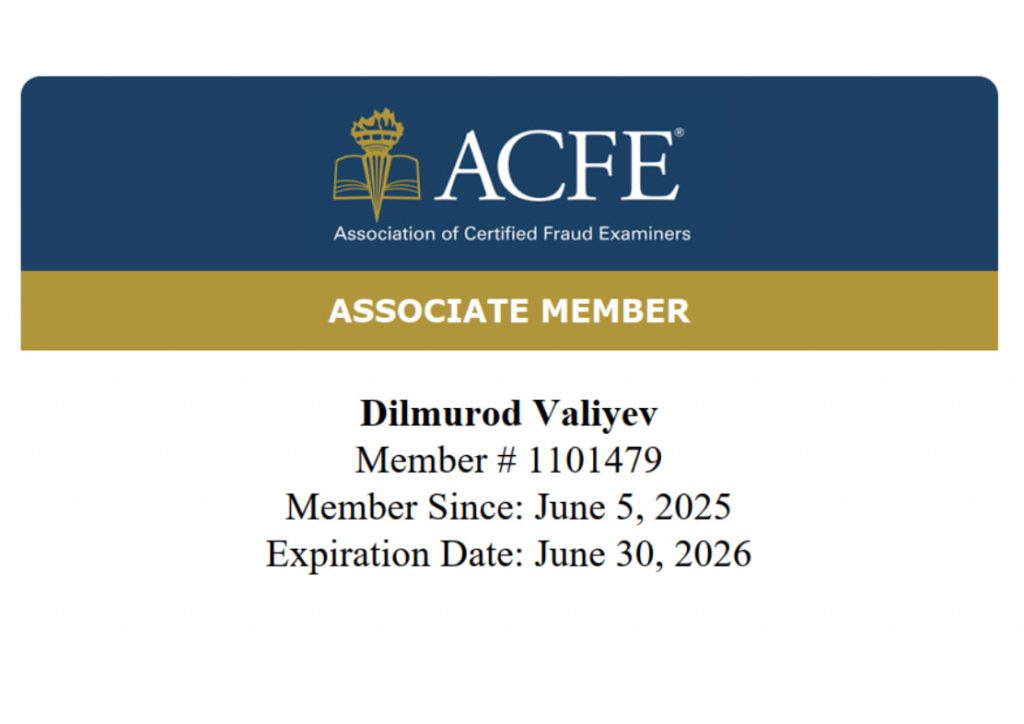

The advantages of our company include Membership in the Association of Certified Fraud Examiners (ACFE) and partnership with European international organizations, which provides our company with the best international experience and methodology for performing the services provided.

What does the Client receive upon completion of the audit?

Upon completion of the work, an Expert-Analytical Report is confidentially provided to the management (Client), which outlines the facts and potential risk areas, as well as recommendations for their resolution to take preventive measures against negative consequences and financial losses.

The Weeknd - After Hours

Are your employees 100% satisfied with their salary?

Are your employees satisfied with their position in the organization?

Are you completely confident in your staff?

If you answered “No” - the probability of fraud is 50%.

Do you have an approved anti-fraud response plan?

Have you implemented a system for collecting electronic documentary evidence of financial misconduct?

Do you frequently change your audit firm?

Do you personally select the audit firm?

Have any cases of fraud been identified in your company during the past year?

If you answered “No” - Congratulations! There’s a 100% chance that someone is stealing from you.

Cases

Examples of projects we have worked on

"Software Purchase"

A large organization purchased and implemented software, but its cost turned out to be inflated and its quality did not meet the specifications, raising suspicions about the procurement officer’s vested interests.

A forensic audit was conducted: documentation was reviewed and the procurement scheme was analyzed, and the fact of cost overruns and product non-compliance was established.

The violation was confirmed, and the client received recommendations to revise the procurement terms and strengthen controls.

"Engaging the services of a tax consultant"

A manufacturing company faced claims from tax authorities for violating deductions and benefits, and the threat of fines. They consulted a consultant, but doubts arose about the accuracy of the decisions.

An audit of tax policy was conducted, reporting and application of benefits were verified, and errors and shortcomings were identified.

Reporting adjustments were made, recommendations for optimization and risk reduction were drawn up, and fines were avoided.